Budgeting and Reporting Software for Technology and Fast Growth Companies

Integrated Financial Planning

Cash is king! Without cash a company cannot survive let alone grow. For fast growth companies, where revenue streams are not guaranteed, it is vital to plan cash flow carefully. With Corporate Planner Finance, model in detail, debtors, creditors, investments and financing. P&L, Balance Sheet and Cash flow are fully integrated so that any change in assumptions, automatically feeds through and updates the overall plan. Use the same model to analyse short and long term forecasts and to produce reports. Save time, each month preparing reports and forecast templates with a standardised system with a single point of truth.

Multiple Scenarios for different stakeholders

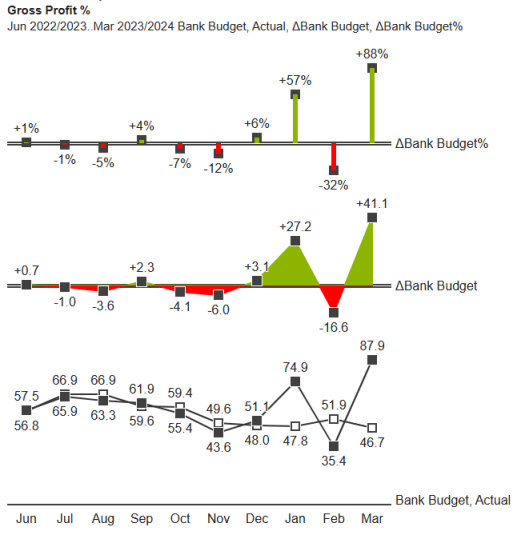

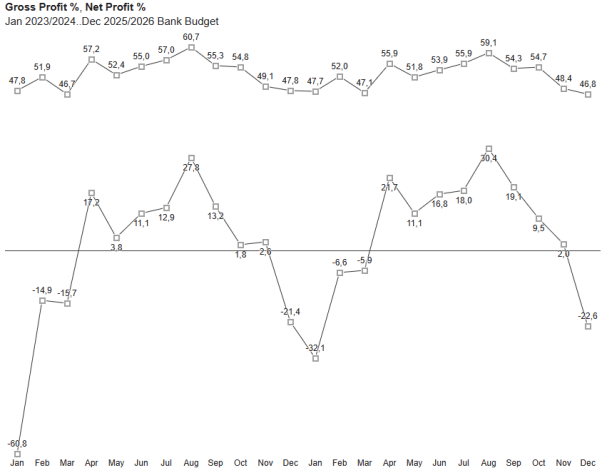

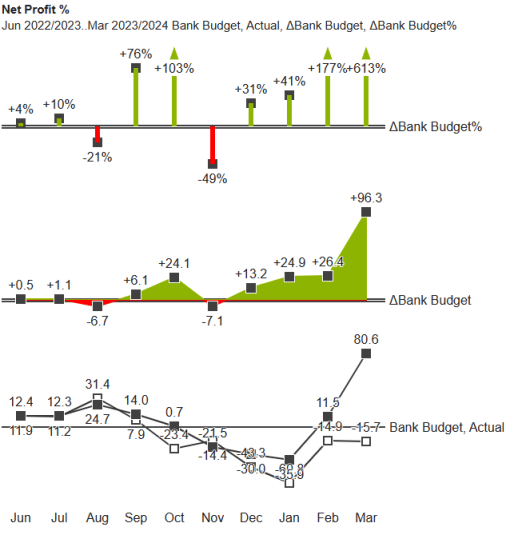

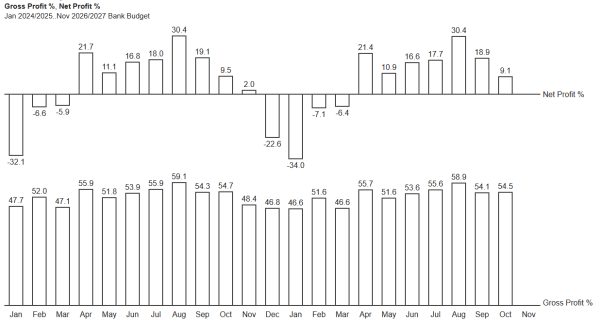

With Corporate Planner you can create multiple scenarios e.g. bank budgets, management budgets and department budgets, each with different performance targets. Variances to budgets and forecasts can be easily analysed in the single financial model. Use the scenarios for best and worst case so that you are prepared for all eventualities.

Funding Rounds, Exit Strategy’s and Covenants

For many fast-growing companies it is imperative to obtain additional funding to enable further growth or an exit strategy. Whether the funding is from Venture Capital, private investors, or standard lenders, all will want to see the current financial status and forecasts for the company. As well as a forecast, there will often be requirements to show different growth scenarios. Failure to be able to answer questions clearly or show how risks are managed could lead to not successfully obtaining additional funding. With all investments clear regular financial forecasts and covenants reporting often are established. The ability to run rolling forecasts easily update covenant calculations is vital. Having a reliable planning model, where changes can be rapidly made.

Growth and acquisitions

Corporate Planner can model changes to your business from expansion by setting up new sites, or acquisition of other companies. Use the scenarios to plan these changes. CP Consolidation can aid modelling acquisition of additional entities as well as financial consolidation of existing group companies.

Book a FREE Demo of Our Software

If you're looking for a budgeting, planning, forecasting, and reporting process book your demo with us today!

5 Ways to Reduce Time on Budgeting and Forecasting

Are you looking for ways to make better decisions for your business? If the answer is yes, we have just the resource for you! Our guide is designed to show you how you can save time on budgeting and forecasting in your business.

Fill in Your Details to Get Your FREE Guide

From Our Blog

Stay up to date with what is new in our industry, learn more about the upcoming products and events.

How Forecasting Software Can Help Your Business Navigate Financial Opportunities And Challenges

How the Worsening Financial Situation in Higher Education Changes Forecasting Needs