How Financial Planning Software Helps You Survive Financial Challenges

In 2024, many businesses are finding themselves in a difficult financial situation, with the cost-of-living crisis not long having peaked. Whilst inflationary pressures are easing, businesses are facing many other challenges, threats and uncertainties. These include markets, supply and price threats from many military conflicts around the world; the future level of interest rates and business and consumer taxes; political uncertainty from the forthcoming general election; etc.

The effect of these has been that more businesses are experiencing ‘stress’ and the need to keep a very close eye on their bottom line in order to continue to reach their forecasted goals.

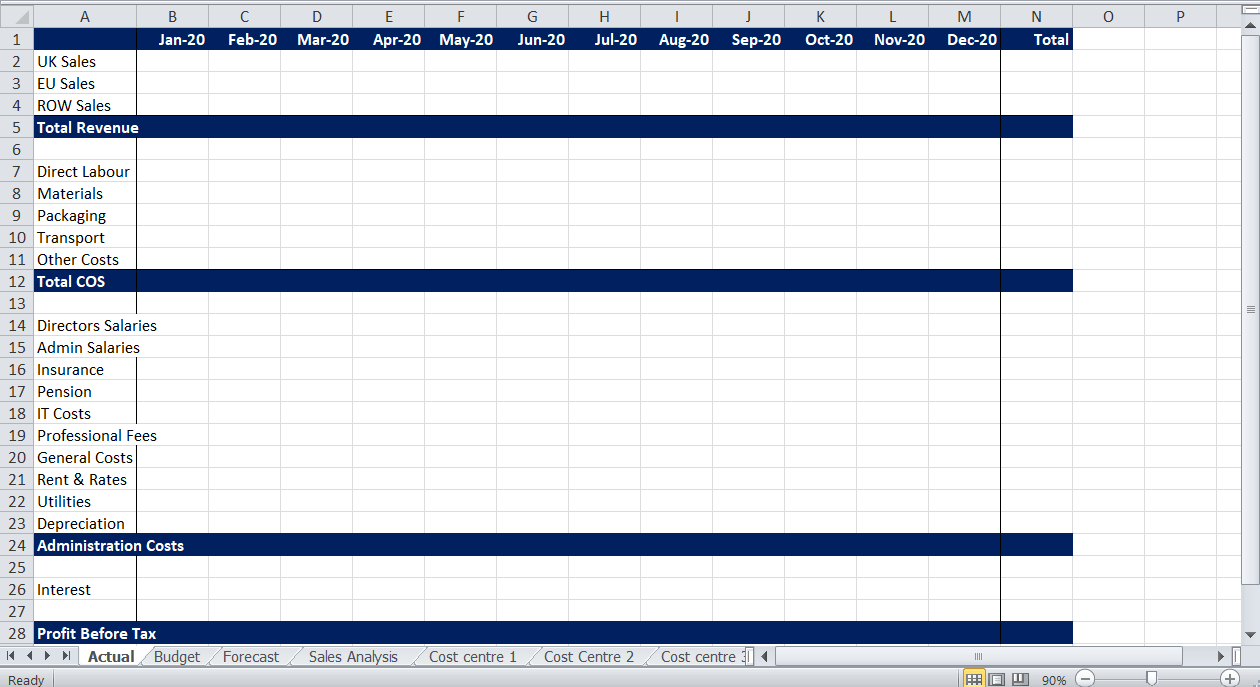

So how can businesses best protect themselves, and even thrive, under such circumstances? One important way is by having a planning process and software that combines and manages 3 key tasks in an integrated way:

- Identifying and Managing Immediate Short-term Threats: this encompasses near-term cash flow planning, balance sheets, P&L and especially the assurance of achieving banking covenant terms and the availability of necessary funding. The planning software requires the ability to re-forecast rapidly, to run multiple scenarios and to identify key actions for continued ‘ongoing concern’.

- Planning Round Process: The ‘standard planning round’ activities continue with marketing, sales, production, investment, overhead support activity etc. planning. But in times of stress there is an increased need to identify, quantify, and prioritise activities and channels that ‘make money’, and to cut back on those activities and assets that add no real value, or worse, lose money. Overhead and support costs also need to be ruthlessly simplified. The planning software needs to be capable of bringing these assessments and decisions to the forefront attention of managers.

- Strategic Development: For almost all businesses the future is secured by investment in growth and in markets, services, and products where they can excel. The planning process needs to encapsulate this activity just as much as managing short-term threats and the standard planning round.

- Modern ‘planning software’ can uniquely help you achieve these 3 key tasks in an integrated way:

- Modelling and reporting any immediate short-term threats, e.g. to cash flow, banking covenants and financing; prioritising and quantifying actions to be taken

- Dealing with ‘all planning round’ activities in an integrated ‘single version of the truth’ manner, with the added benefit of full scenario planning

- Strategic and Operational review, set in context with the existing business model and future opportunities and threats

- All this with personalised web-based access to all key players on an individual roles and rights basis, and a ‘single version of the truth’

- Direct links with drill-down to finance and transaction systems, with links to your data analytics/business intelligence system

- The best modern planning software systems enable you to achieve the above in a progressive manner, not disrupting existing operations. The first benefits can be achievable in as little as 10 days.

Get in touch with the experts

In tricky financial times, budgeting and financial software is one investment that you will not regret. Contact Account-Ability to learn more about how we can help your business navigate these waters and save yourself a lot of time and money in the long run.

Image Source: Canva

Recent Articles

Subscribe to our blog

You May Also Like

These Related Stories

The Importance Of Financial Planning In An Uncertain Economy

Is your financial planning and reporting limited by inflexible and inefficient technology?