4 Factors To Consider When Choosing Forecasting Software For Your Business

Accurate financial forecasting is the compass that guides strategic business decision-making, but without the right tools, it can become an exercise in frustration. Conversely, the right business forecasting software can turn this challenge into an opportunity, providing the insights required for the business to succeed. But how do you select the right one? Here are four key factors to consider.

1. Aligning With Your Forecasting Goals

Every business has unique forecasting needs. Some may require detailed short-term forecasts to manage cash flow, while others may need to focus on long-term forecasts for strategic planning. The ideal forecasting software should cater to these specific needs. It should be capable of delivering accurate and reliable data, supporting both short and long-term planning.

For instance, if your business often faces market disruptions, software that can reduce your response time to such changes would be invaluable. It is not just about having a tool that can crunch numbers but one that understands the nuances of your business and can adapt to your specific forecasting requirements.

2. User-Friendly Interface For Seamless Operations

The efficiency of your forecasting process is heavily dependent on the ease of use of your software. A complex, hard-to-navigate interface can slow down operations, frustrate users, and lead to errors. On the other hand, a user-friendly interface can significantly reduce cycle times and improve productivity.

A platform that offers a fast, intuitive interface can be quickly adopted by all team members, regardless of their technical ability, enhancing overall efficiency. Again, it is about ensuring that the software is a facilitator, not a barrier, to your forecasting process.

3. Accessibility For A Flexible Work Environment

With the rise of remote working and the increasing need for flexibility, having tools that can be accessed from anywhere has become a necessity. Cloud-based forecasting software offers this flexibility, allowing your team to work from any location at any time.

It improves convenience and ensures that your data is securely stored and readily available when needed. Imagine being able to access your forecasting data while on a business trip or working from home. That is precisely the kind of flexibility modern businesses need. It is about breaking down geographical barriers and ensuring your forecasting process is as agile as the business.

4. Accuracy For Reliable Decision-Making

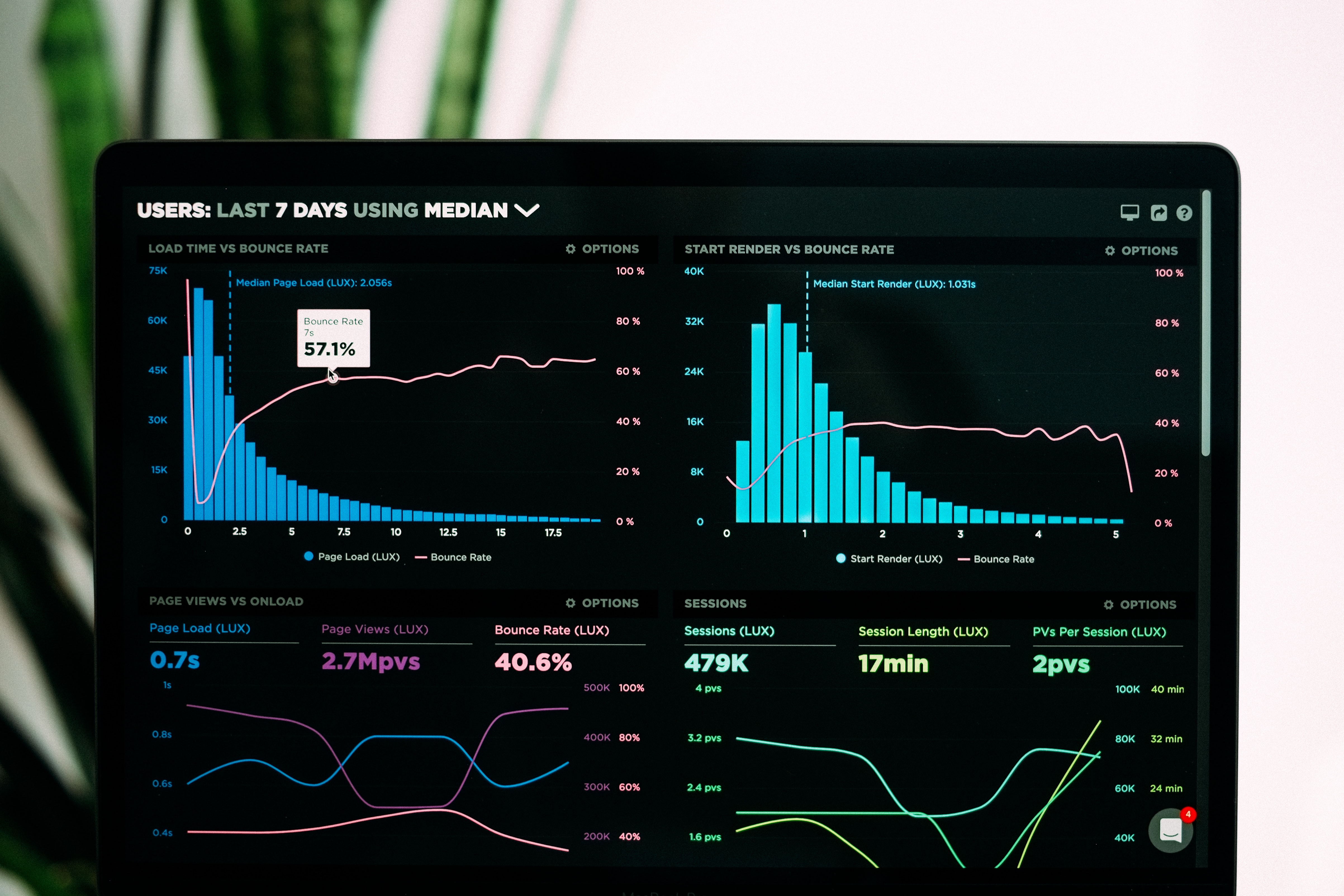

The value of a forecast lies in its accuracy. A forecasting tool that consistently delivers accurate results is a powerful asset. It should provide reliable data, minimising the difference between predicted and actual sales values.

For instance, software that links cash flow forecasting with operational forecasts can provide more accurate and reliable cash flow forecasts, leading to better financial decisions. It is not just about predicting numbers but ensuring that these predictions are as close to reality as possible.

The Strategic Choice Of Forecasting Software

Selecting the right forecasting software is a strategic move with significant implications for your business's financial planning and success. By focusing on your forecasting needs, usability, accessibility, and accuracy, you can harness the full power of financial forecasting. The ideal tool should cater to your current needs and adapt to your evolving business.

Discover The Benefits Of Corporate Planner

Corporate Planner is one of the world’s leading all-in-one business forecasting platforms, used by thousands of enterprises in a wide range of sectors. Request a quote today and discover a solution tailored to your needs, ready to fuel your business's journey towards financial excellence.

Image Source: PexelsRecent Articles

Subscribe to our blog

You May Also Like

These Related Stories

Why Corporate Performance Management Software Is A Must For All Organisations – 6 Key Investment Benefits

How Budgeting Software Can Improve Efficiency in the Property and Real Estate Sector