Corporate Performance Management Solutions For Finance Directors & FP&A Professionals

Discover how award-winning Corporate Planner software streamlines and integrates FP&A

.webp?width=80&height=80&name=UK%20Office%20(1).webp)

UK Based Offices

.webp?width=80&height=80&name=Quick%20turn%20around%20(1).webp)

10 to 15 Day Turnaround

.webp?width=80&height=80&name=UK%20Buisness%20(1).webp)

UK Consultants & Trainers

.webp?width=80&height=80&name=UK%20Hosting%20(1).webp)

European Based Hosting

Personalised Support Service

.webp?width=80&height=80&name=UK%20Office%20(1).webp)

UK Based Offices

.webp?width=80&height=80&name=Quick%20turn%20around%20(1).webp)

10 to 15 Day Turnaround

.webp?width=80&height=80&name=UK%20Buisness%20(1).webp)

UK Consultants & Trainers

.webp?width=80&height=80&name=UK%20Hosting%20(1).webp)

European Based Hosting

European Based Hosting

Single Platform, Four Comprehensive Solutions - Your Integrated Business Plan and Financial Forecast

Operational Budgeting, Planning, Forecasting and Reporting

Operational budgeting, planning, and forecasting are typically detailed processes which are tedious and time-consuming. Worse still, the assembled plan often lacks transparency and version control. Corporate Planner OC solves all of these problems.

Discover More

Integrated P&L, Balance Sheet & Cash Flow Statement Planning

Integrated financial statements, plans and forecasts are key to ensuring the financial health of your organisation. Corporate Planner Finance transforms and automates many of these tasks. Read more to see how and the benefits you can gain.

Discover More

Sales Planning, Forecasting and Reporting

Planning and forecasting sales is vital for any organisation. Understanding and managing key sources of revenue is essential to forming the business plan and financial forecast. Corporate Planner Sales solves these needs.

Discover More

Financial Consolidation

Preparing accurate consolidated financial statements for a group of companies is typically complex, time-consuming and resource-intensive. Corporate Planner Consolidation systemises this process bringing large savings in time and resource, increasing accuracy and many other benefits.

Discover More

Our software benefits organisations of all sizes from all sectors

Corporate Planner software is scalable to meet the needs of any organisation from SME to FTSE 100. And is easily configurable to the precise needs of any sector, including:

5 Ways to Reduce Time on Budgeting and Forecasting

Are you looking for ways to make better decisions for your business? If the answer is yes, we have just the resource for you! Our guide is designed to show you how you can save time on budgeting and forecasting in your business.

Fill In Your Details To Get Your FREE Guide

Cut planning cycle time, seamlessly connect data, build collaborative performance management across your organisation

Corporate Planner’s single platform delivers an integrated solution for all of the following:

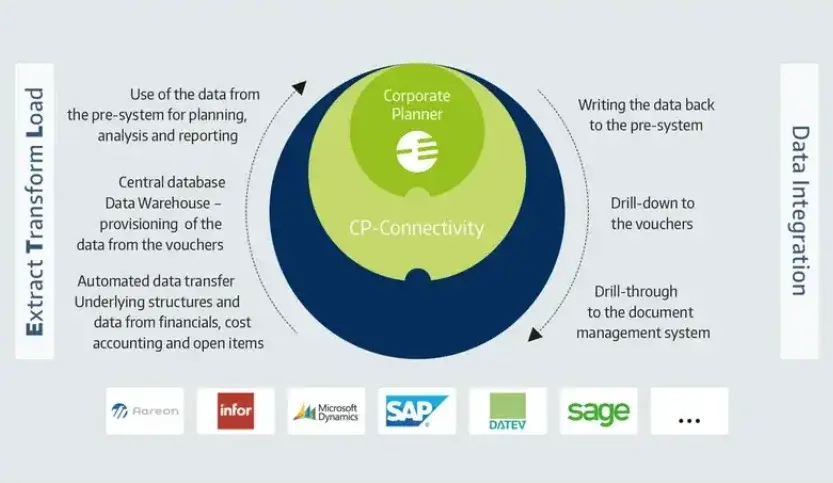

Seamlessly Connected To Your System Environment

Our Corporate Planner solutions empower you to report, model, and plan every financial aspect of your business with ease. Thanks to Corporate Planner Connectivity Express, you can seamlessly connect to your existing systems - whether it’s ERP software, financial and cost accounting tools, or payroll processing platforms.

These reliable integrations automate data transfers and enable drill-downs to transactions and vouchers, ensuring up-to-date, accurate data for planning, analysis, and reporting. This not only saves you time and effort but also reduces errors, providing management with more structured, timely, and actionable insights to drive better decision-making.

Implementation, Training and Support

Account-Ability Ltd provide a first line of support for Corporate Planner to all our customers. Customers can contact Account-Ability consultants directly via email.

Account-Ability provides:

Fast, efficient skills transfer implementation consultancy

The option for full turnkey implementation

Initial and on-going training

Highly bespoke on-going support

FAQ

Account-Ability Ltd was founded in 1998. Account-Ability was established to help businesses with their financial planning and analysis.

Account Ability saw that many managers in business did not have the key financial and non financial data readily available as a result managers were unable to make the necessary strategic decisions quickly enough. Managers were unsure of their performance, budget and forecast cycles were a slow and painful process.

Account-Ability Ltd was founded in 1998. Account-Ability was established to help businesses with their financial planning and analysis.

Account Ability saw that many managers in business did not have the key financial and non financial data readily available as a result managers were unable to make the necessary strategic decisions quickly enough. Managers were unsure of their performance, budget and forecast cycles were a slow and painful process.

Account-Ability Ltd was founded in 1998. Account-Ability was established to help businesses with their financial planning and analysis.

Account Ability saw that many managers in business did not have the key financial and non financial data readily available as a result managers were unable to make the necessary strategic decisions quickly enough. Managers were unsure of their performance, budget and forecast cycles were a slow and painful process.

Account-Ability Ltd was founded in 1998. Account-Ability was established to help businesses with their financial planning and analysis.

Account Ability saw that many managers in business did not have the key financial and non financial data readily available as a result managers were unable to make the necessary strategic decisions quickly enough. Managers were unsure of their performance, budget and forecast cycles were a slow and painful process.

Frequently Asked Questions

What is Corporate Planner?

Corporate Planner is a leading FP&A solution tailorable to meet the needs of organisations from all sectors. Continuously developed by CP Corporate Planning for over 30 years, and incorporating the latest trends in FP&A, Corporate Planner consists of four integrated modules that provide everything required for budgeting, forecasting, reporting, integrated financial planning and statutory financial consolidation. The four modules cover Operational Controlling; Sales Controlling; Integrated Financial Planning and Financial Consolidation. Each can be implemented independently, or together, ensuring there is no need to purchase more than you require.

Corporate Planner can integrate with your finance, ERP and other pre-systems, delivering drilldown to transaction level and making for easy and error-free data import.

Corporate Planner delivers web-based professional reporting and analysis and integration/export capability to BI and multi-dimensional analysis systems.

Who are Account-Ability?

Account- Ability is the leading international sales, implementation, support and training partner of CP Corporate Planning. We have been partners for nearly 30 years and are expert in all aspects of the software, it’s implementation and support. We have implemented Corporate Planner in over 160 organisations ranging in size from £10M turnover to FTSE 100 companies, covering all sectors, including public sector and not-for-profit.

How long does Corporate Planner take to implement?

Implementation, depends upon the scope and specific requirements. However typical implementation range from 10 – 20 days, for a P&L balance sheet and cash flow planning model. Sales and P&L budgeting models can often be implemented in as little as 6 to 10 days.

How much does Corporate Planner cost to implement?

Software costs depends upon the requirements, the number of modules and the number and type of users. Typically software costs £500 - £1,500 per month on the CP-Cloud. The software is also available as an on premise, perpetual licence purchase.

What is your largest competitor?

Most organisations come to us because they are using Excel spreadsheets for business critical FP&A tasks. Despite concerns that Excel slow to develop, hard to edit, error-prone and frequently dependent on the knowledge of a single individual, they need the confidence that moving to a dedicated FP&A solution like Corporate Planner will deliver the solution to the inefficiencies and limitations of Excel. Our consultative sales process in which we seek to understand your priorities and demonstrate how these can be achieved with your data is a proven way of providing that confidence.

Outside of Excel the FP&A market falls into three broad categories:

- Systems that have a basic level of dedicated FP&A functionality and efficiency beyond what Excel offers but lack the advanced level features and flexibility that most Finance Directors are looking for. These systems are likely to be most suitable for smaller organisations with a turnover of less than ~ £10M pa

- Large enterprise-wide systems, typically integrated as part of a ‘whole system ERP project’ and accessed by 100’s of users. These systems offer very high levels of functionality but typically come with a high price ticket and long project implementation times to achieve the objectives

- Systems, such as Corporate Planner which hit the ‘sweet-spot needs’ of most organisations, in that they solve the problems of Excel, offer very high levels of FP&A capability, are extremely flexible, fast and affordable to implement, and deliver a self-serve solution that is not dependent on on-going consultancy support

Is Corporate Planner Suitable for my company?

Corporate Planner is a generic planning and reporting system. It has been implemented in over 4000 companies across UK and Europe. You can define your own organization structure, charts of account, planning logic, sales channels, reporting formats etc. The Operational Controlling module delivers highly detailed and easy to set up and to maintain up modelling. The CP-Finance module provides a uniquely intuitive and rapid process for setting up the integrated P&L, Balance Sheet, Cashflow and capital asset and loans relationships. For organisations requiring formal financial consolidation, the CP-Consolidation module offers class-leading capability. Corporate Planner is the ideal integrated FP&A for organisations from all sectors, private, not-for-profit, and public (see sector pages)

Why choose Corporate Planner?

Corporate Planner is one of the fastest budgeting, forecasting, reporting and consolidation solution to implement. BARC surveys have consistently shown short successful projects and maintained by the finance teams. Corporate Planner has many pre-defined planning, consolidation and reporting tools. These tools enable quick set up, easy maintenance of financial planning and reporting models. Models can be built rapidly in few days and are easily maintained.

Corporate Planner can be implemented and maintained by finance teams. Some other budgeting and reporting software solutions rely heavily on external consultants or internal IT support to help maintain the system.

Can you integrate with my finance system?

Corporate Planner has direct integrations with over 400 different finance systems. These include Sage, SAP , Oracle, Microsoft Dynamics, Microsoft Business Central, Unit4, Technology One, Infor and many more. The integration team can set up integrations with new finance systems as part of the project.

Do I have to use integrations?

No data can be imported to Corporate Planner from csv or Excel. We do often recommend using integrations for financial consolidation as these can often ensure faster close with intercompany data postings identified from the transactional data.

Is the CP Cloud the same as on premise Corporate Planner?

Corporate Planner is offered as both an on premise solution as well as cloud based software. The software is the same, the only difference is if it is installed on your servers or in the CP Cloud.

What are the benefit of the CP Cloud?

The key benefits of the CP Cloud is software maintenance, security and availability. The CP Cloud is hosed on MS Azure datacentres. The cloud is fast to set up and the software is updated automatically with each new release.

Book a FREE Demo of Our Software

If you're looking for a budgeting, planning, forecasting, and reporting process book your demo with us today!

From Our Blog

Stay up to date with what is new in our industry, learn more about the upcoming products and events.

5 Strategic Priorities for CFOs in 2025/26

How Modern FP&A Software Enables You to Plan with More Confidence